All Categories

Featured

Table of Contents

There is no payment if the plan runs out prior to your death or you live past the policy term. You may be able to renew a term plan at expiry, however the costs will be recalculated based upon your age at the time of renewal. Term life insurance coverage is usually the the very least costly life insurance coverage offered because it supplies a survivor benefit for a restricted time and doesn't have a cash money worth component like irreversible insurance.

At age 50, the costs would certainly increase to $67 a month. Term Life Insurance Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for guys and ladies in excellent wellness.

Level Premium Term Life Insurance Policies Do What

Rate of interest rates, the financials of the insurance policy company, and state policies can also impact costs. When you take into consideration the amount of insurance coverage you can get for your premium dollars, term life insurance policy tends to be the least costly life insurance.

He gets a 10-year, $500,000 term life insurance policy with a premium of $50 per month. If George dies within the 10-year term, the policy will certainly pay George's recipient $500,000.

If George is detected with an incurable ailment throughout the first plan term, he possibly will not be qualified to renew the plan when it runs out. Some policies supply ensured re-insurability (without proof of insurability), but such functions come at a greater price. There are several sorts of term life insurance policy.

Most term life insurance policy has a level premium, and it's the type we have actually been referring to in many of this post.

Annuity Vs Term Life Insurance

Term life insurance is attractive to young individuals with kids. Moms and dads can obtain substantial coverage for an inexpensive, and if the insured dies while the plan holds, the family can count on the survivor benefit to replace lost earnings. These plans are likewise appropriate for individuals with expanding families.

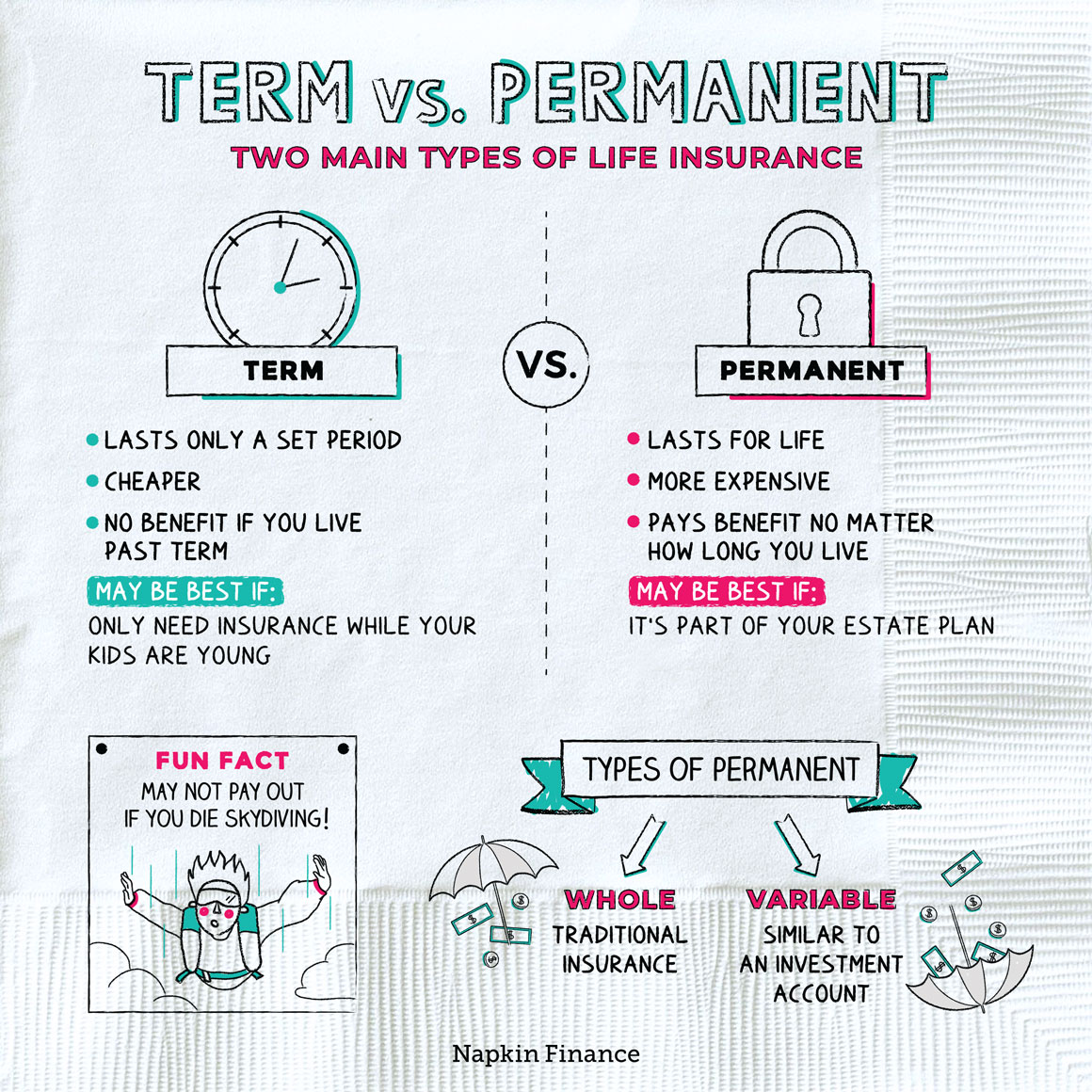

The ideal option for you will certainly depend upon your needs. Here are some things to think about. Term life policies are ideal for people who desire substantial insurance coverage at an affordable. People that possess entire life insurance policy pay a lot more in costs for less protection however have the safety of understanding they are shielded forever.

The conversion cyclist must permit you to convert to any kind of irreversible plan the insurance firm offers without restrictions - 10 year term life insurance meaning. The main functions of the motorcyclist are maintaining the initial health ranking of the term plan upon conversion (also if you later on have wellness issues or end up being uninsurable) and determining when and exactly how much of the insurance coverage to transform

Of training course, overall costs will raise significantly since entire life insurance coverage is a lot more pricey than term life insurance policy. The advantage is the ensured approval without a clinical exam. Clinical conditions that develop during the term life duration can not create premiums to be enhanced. Nevertheless, the firm may require restricted or complete underwriting if you wish to add extra riders to the brand-new plan, such as a long-lasting treatment rider.

Term life insurance policy is a relatively inexpensive method to supply a swelling amount to your dependents if something takes place to you. It can be an excellent alternative if you are young and healthy and balanced and sustain a household. Whole life insurance policy comes with substantially higher month-to-month premiums. It is implied to supply protection for as long as you live.

Group Term Life Insurance Vs Individual

Insurance policy business established a maximum age restriction for term life insurance policy policies. The costs likewise rises with age, so an individual aged 60 or 70 will pay significantly even more than a person years more youthful.

Term life is somewhat similar to vehicle insurance. It's statistically not likely that you'll require it, and the premiums are money down the drain if you do not. Yet if the most awful occurs, your family members will get the advantages.

This policy layout is for the client who needs life insurance policy however want to have the capacity to pick just how their money value is invested. Variable plans are underwritten by National Life and dispersed by Equity Services, Inc., Registered Broker/Dealer Associate of National Life Insurance Business, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 award details, see Long-term life insurance policy establishes money value that can be borrowed. Policy car loans build up rate of interest and overdue policy lendings and rate of interest will reduce the survivor benefit and cash money worth of the policy. The amount of money worth readily available will typically depend upon the sort of irreversible plan acquired, the amount of protection acquired, the length of time the plan has actually been in force and any type of exceptional plan loans.

Does Term Life Insurance Cover Disability

Disclosures This is a general summary of protection. A complete statement of protection is located just in the policy. For even more information on coverage, expenses, restrictions, and renewability, or to apply for coverage, call your regional State Ranch representative. Insurance coverage and/or linked riders and attributes might not be readily available in all states, and plan terms might differ by state.

The major differences in between the different sorts of term life policies on the marketplace relate to the length of the term and the insurance coverage quantity they offer.Level term life insurance features both level premiums and a level survivor benefit, which suggests they stay the very same throughout the period of the plan.

It can be restored on an annual basis, yet costs will increase every time you renew the policy.Increasing term life insurance policy, additionally called a step-by-step term life insurance policy strategy, is a policy that includes a death advantage that enhances in time. It's usually more intricate and expensive than level term.Decreasing term life insurance policy comes with a payout that lowers over time. Typical life insurance coverage term lengths Term life insurance policy is cost effective.

Although 50 %of non-life insurance proprietors mention cost as a reason they do not have coverage, term life is among the most inexpensive kinds of life insurance policy. You can often obtain the coverage you need at a workable rate. Term life is very easy to take care of and comprehend. It supplies protection when you most require it. Term life uses financial security

throughout the period of your life when you have significant financial commitments to satisfy, like paying a home loan or funding your children's education. Term life insurance policy has an expiry date. At the end of the term, you'll require to get a new plan, restore it at a greater premium, or transform it right into irreversible life insurance if you still want coverage. Rates may differ by insurance firm, term, coverage amount, health course, and state. Not all plans are available in all states. Rate picture valid as of 10/01/2024. What elements affect the expense of term life insurance policy? Your rates are determined by your age, sex, and health, in addition to the protection quantity and term length you choose. Term life is an excellent fit if you're trying to find a cost effective life insurance policy policy that only lasts for a set amount of time. If you require permanent insurance coverage or are considering life insurance policy as a financial investment alternative, entire life may be a better option for you. The major differences in between term life and whole life are: The length of your protection: Term life lasts for a set time period and then ends. Ordinary monthly entire life insurance policy rate is computed for non-smokers in a Preferred health category, obtaining an entire life insurance policy paid up at age 100 supplied by Policygenius from MassMutual. Rates might differ by insurer, term, insurance coverage quantity, health course, and state. Not all policies are readily available in all states. Temporary life insurance coverage's momentary plan term can be a good choice for a few circumstances: You're awaiting authorization on a long-lasting plan. Your policy has a waitingduration. You're in between jobs. You intend to cover short-lived responsibilities, such as a car loan. You're improving your health and wellness or way of life(such as giving up cigarette smoking)before getting a conventional life insurance coverage plan. Aflac supplies various long-term life insurance policies, including entire life insurance policy, last cost insurance, and term life insurance policy. Start chatting with an agent today to read more concerning Aflac's life insurance policy products and discover the right choice for you. One of the most popular kind is now 20-year term. A lot of business will certainly not sell term insurance to an applicant for a term that ends past his or her 80th birthday celebration . If a policy is"renewable," that implies it proceeds effective for an extra term or terms, up to a defined age, even if the health and wellness of the guaranteed (or other variables )would create him or her to be rejected if she or he got a brand-new life insurance plan. So, premiums for 5-year renewable term can be degree for 5 years, after that to a new rate mirroring the new age of the guaranteed, and so forth every 5 years. Some longer term plans will ensure that the costs will certainly notraise throughout the term; others do not make that warranty, enabling the insurance provider to increase the rate throughout the plan's term. This suggests that the policy's owner has the right to change it right into a long-term sort of life insurance without added proof of insurability. In most kinds of term insurance, including property owners and auto insurance policy, if you haven't had an insurance claim under the policy by the time it runs out, you obtain no reimbursement of the costs. Some term life insurance policy consumers have been dissatisfied at this result, so some insurance firms have actually created term life with a"return of costs" function. The costs for the insurance with this function are frequently substantially more than for plans without it, and they generally require that you maintain the policy active to its term otherwise you waive the return of costs benefit. Married with young kids-Life insurance policy can assist your spouse maintain your home, current way of living and offer your youngsters's support. Single moms and dad and single income producer- Life insurance coverage can aid a caretaker cover childcare prices and various other living costs and accomplish strategies for your youngster's future education and learning. Married without kids- Life insurance policy can supply the cash to satisfy financial responsibilities and aid your partner hold onto the assets and way of life you've both functioned difficult to attain. You may have the choice to convert your term plan to permanent life insurance. Insurance coverage that protects a person for a defined period and pays a death benefit if the covered individual passes away throughout that time. Like all life insurance policy policies, term protection assists maintain a household's financial well-being in situation a loved one passes away. What makes term insurance coverage various, is that the insured person is covered for a particularquantity of time. Since these policies do not offer lifelong insurance coverage, they can be relatively budget-friendly when contrasted with a long-term life insurance policy policy with the very same amount of protection. While the majority of term plans use dependable, short-term security, some are more flexible than others. At New York Life, our term policies provide a distinct combination of functions that can assist if you come to be impaired,2 come to be terminally ill,3 or just wish to transform to an irreversible life plan.4 Considering that term life insurance policy offers temporary protection, many individuals like to match the length of their policy with an essential turning point, such as repaying a home loan or seeing children via university. Level costs term can be much more efficient if you desire the costs you pay to continue to be the same for 10, 15, or two decades. Once that period ends, the amount you spend for protection will certainly boost yearly. While both kinds of coverage can be efficient, the choice to pick one over the various other comes down to your particular demands. Because no person understands what the future has in shop, it is necessary to ensure your insurance coverage is reliable enough to satisfy today's needsand adaptableadequate to aid you plan for tomorrow's. Here are some essential variables to bear in mind: When it pertains to something this important, you'll intend to ensure the firm you utilize is monetarily sound and has a tested history of maintaining its pledges. Ask if there are functions and benefits you can utilize in case your needs alter later on.

Latest Posts

Level Term Life Insurance Meaning

What Is The Difference Between Term And Universal Life Insurance

Term Life Insurance Coverage Characteristics