All Categories

Featured

Table of Contents

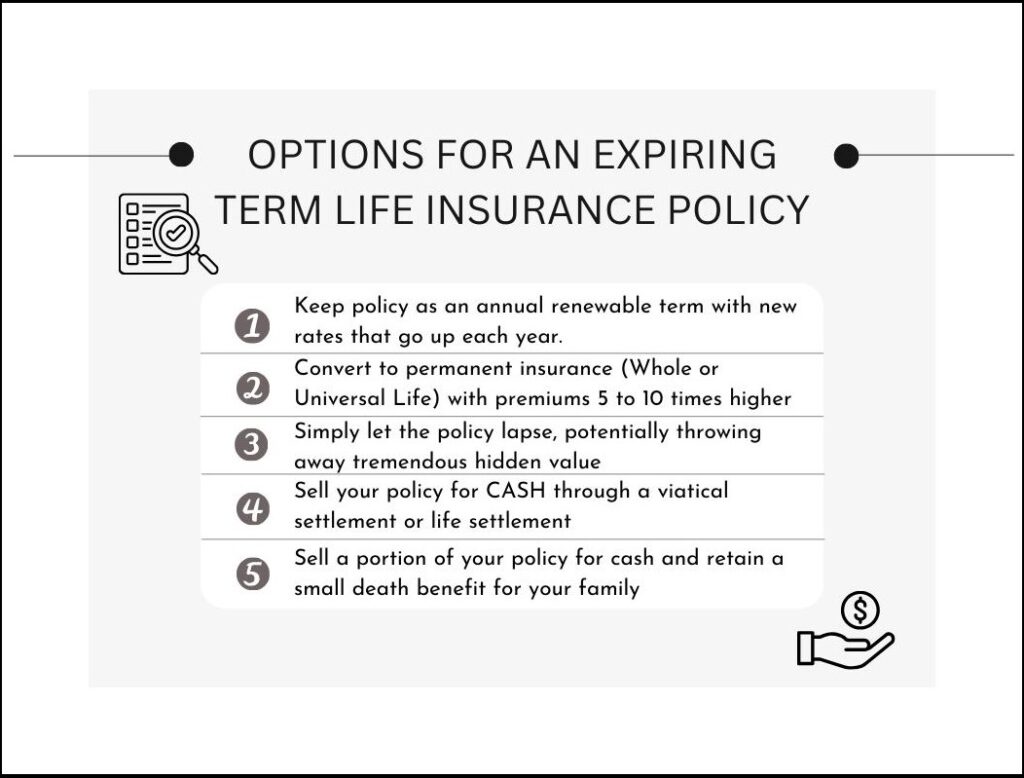

There is no payment if the policy ends prior to your death or you live beyond the plan term. You might be able to restore a term plan at expiration, however the costs will certainly be recalculated based on your age at the time of renewal.

At age 50, the costs would climb to $67 a month. Term Life Insurance policy Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for guys and women in exceptional health and wellness.

Group Life Insurance Vs Term Life Insurance

The reduced threat is one variable that permits insurance providers to charge reduced premiums. Rate of interest, the financials of the insurance coverage business, and state policies can also affect costs. Generally, companies commonly provide far better rates at the "breakpoint" protection degrees of $100,000, $250,000, $500,000, and $1,000,000. When you consider the quantity of protection you can obtain for your premium bucks, term life insurance policy tends to be the least costly life insurance policy.

Thirty-year-old George intends to safeguard his household in the unlikely event of his sudden death. He buys a 10-year, $500,000 term life insurance coverage policy with a costs of $50 monthly. If George dies within the 10-year term, the policy will certainly pay George's beneficiary $500,000. If he dies after the policy has ended, his recipient will certainly receive no advantage.

If George is identified with a terminal health problem throughout the initial policy term, he most likely will not be qualified to renew the plan when it ends. Some policies provide assured re-insurability (without evidence of insurability), yet such features come with a greater price. There are numerous sorts of term life insurance policy.

Many term life insurance has a degree costs, and it's the type we have actually been referring to in many of this article.

Reduced Paid Up Term Life Insurance

Term life insurance coverage is eye-catching to young people with youngsters. Moms and dads can get substantial insurance coverage for an inexpensive, and if the insured dies while the plan is in effect, the household can rely upon the survivor benefit to change lost income. These plans are also fit for individuals with growing family members.

The best option for you will certainly depend upon your requirements. Here are some points to consider. Term life plans are excellent for people who desire significant insurance coverage at an affordable. Individuals who own entire life insurance coverage pay extra in premiums for less protection but have the protection of knowing they are shielded permanently.

The conversion motorcyclist ought to allow you to convert to any kind of permanent policy the insurance provider uses without constraints - couple term life insurance. The primary features of the biker are keeping the original health rating of the term policy upon conversion (also if you later have health and wellness issues or come to be uninsurable) and making a decision when and exactly how much of the insurance coverage to convert

Certainly, overall costs will raise dramatically given that whole life insurance is a lot more expensive than term life insurance policy. The benefit is the guaranteed authorization without a clinical exam. Medical conditions that develop during the term life period can not trigger costs to be boosted. Nevertheless, the company may require restricted or complete underwriting if you intend to include extra cyclists to the brand-new plan, such as a long-term care motorcyclist.

Whole life insurance coverage comes with significantly greater month-to-month costs. It is suggested to supply coverage for as long as you live.

Can You Get Term Life Insurance If You Have Cancer

It depends upon their age. Insurance provider set a maximum age limitation for term life insurance policy policies. This is normally 80 to 90 years old yet might be greater or lower depending on the business. The premium likewise rises with age, so a person aged 60 or 70 will pay significantly even more than somebody decades more youthful.

Term life is rather comparable to automobile insurance policy. It's statistically unlikely that you'll require it, and the premiums are money away if you don't. Yet if the most awful takes place, your family will receive the benefits.

This policy design is for the consumer who needs life insurance policy yet would such as to have the capability to choose exactly how their money value is invested. Variable policies are underwritten by National Life and dispersed by Equity Solutions, Inc., Registered Broker/Dealer Associate of National Life Insurance Policy Firm, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor info, see Permanent life insurance develops cash worth that can be borrowed. Policy loans accrue passion and unsettled policy finances and interest will decrease the death advantage and money value of the policy. The quantity of cash worth readily available will typically rely on the sort of irreversible plan purchased, the quantity of protection bought, the length of time the plan has actually been in force and any superior plan finances.

Ladderlife No Medical Exam Term Life Insurance

A total declaration of coverage is found just in the policy. Insurance coverage plans and/or linked bikers and features may not be offered in all states, and policy terms and conditions might differ by state.

The major distinctions in between the different sorts of term life policies on the marketplace pertain to the length of the term and the insurance coverage quantity they offer.Level term life insurance coverage comes with both level costs and a level survivor benefit, which means they stay the very same throughout the duration of the plan.

, additionally known as an incremental term life insurance policy plan, is a policy that comes with a fatality benefit that increases over time. Common life insurance coverage term sizes Term life insurance policy is cost effective.

The major distinctions between term life and entire life are: The length of your coverage: Term life lasts for a collection duration of time and then runs out. Typical monthly entire life insurance policy price is computed for non-smokers in a Preferred health and wellness category, obtaining an entire life insurance coverage policy paid up at age 100 provided by Policygenius from MassMutual. Aflac offers many lasting life insurance plans, including whole life insurance coverage, final cost insurance, and term life insurance policy.

Latest Posts

Level Term Life Insurance Meaning

What Is The Difference Between Term And Universal Life Insurance

Term Life Insurance Coverage Characteristics